Applications can be approved in 2 — 4 weeks. The signer of the Form EZ assumes a lot of liability because of statements and representations in the Form EZ the signer must make under penalties of perjury that the information in the Form is true and correct. More In Forms and Instructions. All Revisions for Form This article discusses the pros and cons of using the Form EZ and who can use the new form. This group should seek professional assistance for their application Private Foundations. Toggle Sliding Bar Area.

| Uploader: | Tazilkree |

| Date Added: | 7 September 2006 |

| File Size: | 69.73 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 3824 |

| Price: | Free* [*Free Regsitration Required] |

We cannot respond to tax-related questions submitted using this page. But as this site has demonstrated time and time throughout the years, your organization successfully can successfully apply and become tax exempt as have thousands of other organizations by filling the IRS Form yourself.

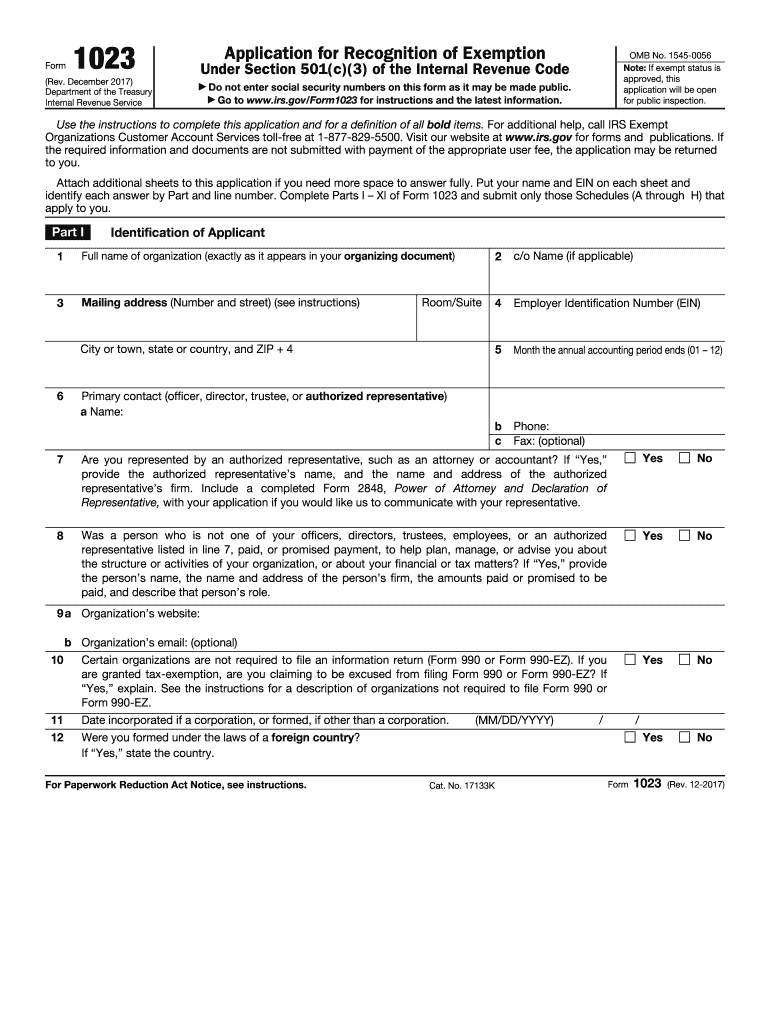

IRS Form 1023-EZ

The IRS may have overestimated the total time to complete and send a 2. Much easier to complete than IRS Rorm All Revisions for Form Page Last Reviewed or Updated: FormInteractive Interactive version of FormApplication for Recognition of Exemption Under Section c 3 of the Internal Revenue Code, includes helpful hints and links to help applicants submit a complete application.

The new Form EZ does simplify and shorten getting a letter from the IRS that an organization is tax exempt, but do not use the new form unless your organization is willing to accept the consequences listed above from the signer of the form is willing to make all the required attestations under penalty of perjury. It does not include helpful hints and links to information on IRS.

Much less time needed to complete the application. This article discusses the pros and cons of using the Form EZ and who can use the new form. Give me the article.

If you resubmit a completed application within the time period indicated in the letter from the IRS, it will be considered received on the original submission date. Incomplete Application If an exemption application does not contain the required information, the IRS for, return it with a letter of explanation, and will not consider the application on its merits.

Different Application Form Needed If a different application form is required for your organization, the IRS will so advise your organization and will provide the appropriate application form for your convenience in reapplying under that paragraph, if you wish to do so.

More In Forms and Instructions. I have implemented many years of my life into preparation of this informational site for no pay and pension so you can achieve your dream, simply because I believe that knowledge should be free, and given the right tools and information, people choose to do good.

Assemble the application and materials in this order: The signer must be the primary dorm who prepares and signs the Form EZ. Applications can be approved in 2 — 4 weeks.

This group should file the IRS Form I know that filling out the Form and preparing your organizational documents was a long process, trust me, I do it every day, but fight the urge of sending your Form application right away. NoticeChanges for Form When a specific application form is needed for the paragraph under which your organization qualifies, that form is required before a letter recognizing fotm can be issued.

Applicants also will be notified if the application is forwarded to the Headquarters of the IRS for consideration.

IRS Form Checklist for Nonprofit Organizations Download

Compare your Form with your Form Attachment foorm make sure that you are not missing any answers. The benefits of applying yourself outweighs the hardship financially and in lessons learned that can be applied to the success and future of your non-profit.

If you need me to review your form and organizing documents to make sure everything is correct please see the Application Review Page. The grand total forj 19 hours!!! Nonprofit organizations formed solely to support other organizations For-profit entities wanting to become a non-profit and file the Form Most people who sign the form will not have the legal knowledge needed to reach that conclusion.

IRS Form EZ - Nonprofit Corporations & Charitable Organizations

Applying for Tax Exempt Status. Before sending out your package, make sure you have a copy of everything, and hope for the best.

The signer of the Form EZ assumes a lot of liability because of statements and representations in the Form EZ the signer must make under penalties of perjury that the information in the Form is true and correct. The IRS form application for tax exemption is explained and examined page by page, step by step and every question is answered with information and references to successful c3 nonprofit applications, sample documents, and complete IRS Form instructions.

Let me know if you liked this page. Although we cannot respond individually to each comment, we do appreciate your feedback and will consider all comments submitted.

Комментариев нет:

Отправить комментарий